News

With 15% Gains This Year Is Fox Corp. A Better Pick Over Textron Stock?

UKRAINE – 2021/12/19: On this photograph illustration Textron Inc. brand seen displayed on a smartphone … [+]

Given its higher valuation and prospects, we imagine Fox Company inventory (NASDAQ: FOXA), an organization shaped because the portion of twenty first Century Fox not acquired by Disney in 2019, is a greater decide than Textron inventory (NYSE: TXT). The choice to take a position usually comes right down to discovering the most effective shares inside the scope of sure traits that go well with an funding fashion. On this case, though these firms are from completely different sectors, they share an analogous income base of round $14 billion and an analogous market capitalization of $16 billion. We see that Fox has seen higher income progress and is extra worthwhile. There may be extra to the comparability, and within the sections under, we talk about why we predict Fox will outperform Textron within the subsequent three years. We evaluate a slew of things, akin to historic income progress, returns, and valuation.

1. TXT Inventory Has Outperformed FOXA In The Final Three Years

TXT inventory has seen extraordinarily sturdy good points of 70% from ranges of $50 in early January 2021 to round $85 now, vs. FOXA inventory which has witnessed good points of simply 15% from $30 to $35 over this era. This compares with a rise of about 45% for the S&P 500 over this roughly three-year interval. Nevertheless, the rise in these shares has been removed from constant. Returns for TXT inventory have been 60% in 2021, -8% in 2022, and 14% in 2023, whereas that for FOX have been 27%, -18%, and -2%, respectively. Compared, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 — indicating that TXT and FOXA underperformed the S&P in 2023.

The truth is, constantly beating the S&P 500 — in good instances and unhealthy — has been tough over current years for particular person shares; for heavyweights within the Industrials sector, together with CAT and HON, and even for the megacap stars GOOG, TSLA, and MSFT. In distinction, the Trefis Excessive High quality Portfolio, with a set of 30 shares, has outperformed the S&P 500 annually over the identical interval. Why is that? As a bunch, HQ Portfolio shares offered higher returns with much less danger versus the benchmark index; much less of a roller-coaster journey, as evident in HQ Portfolio efficiency metrics.

Given the present unsure macroeconomic atmosphere with excessive oil costs and elevated rates of interest, may TXT and FOXA face an analogous scenario as they did in 2023 and underperform the S&P over the subsequent 12 months — or will they see a powerful leap? Whereas we predict each shares will pattern increased, FOXA will probably outperform TXT.

2. Fox’s Income Development Is Higher

Textron has seen its income rise at a mean annual price of 5.5% from $11.7 billion in 2020 to $13.7 billion in 2023. Then again, Fox’s income grew at a mean price of 6.6% from $12.3 billion to $14.9 billion over this era.

Textron’s income progress has been pushed by increased pricing for Aviation, Bell, and Industrial segments. The corporate delivered 168 Quotation jets and 153 industrial turboprops in 2023, versus 132 Quotation jets and 113 industrial turboprops in 2020. Elevated jet deliveries aided industrial gross sales, a pattern anticipated to proceed. Textron has additionally benefited from increased army revenues from the Military Future Assault Reconnaissance Plane program these days. Industrial income is trending increased amid elevated Kautex gross sales and specialised automobile gross sales. Wanting ahead, the corporate expects its 2024 revenues to be round $14.6 billion, up from $13.7 billion in 2023.

Fox’s income progress is being led by its promoting revenues for the Tv section. Fox experiences its revenues in two segments – Cable Community Programming, and Tv. Whereas Cable Community Programming income grew 10% between 2020 and 2023, Tv gross sales have been up 31%, primarily pushed by a 39% rise in promoting gross sales. Wanting ahead, Fox is anticipated to see a powerful gross sales progress within the coming quarters, pushed by continued enchancment in promoting. It ought to profit from the Presidential election cycle within the second half of this yr, and the Tremendous Bowl in 2025.

3. Fox Is Extra Worthwhile

Textron’s working margin expanded from 4.4% in 2020 to 7.7% in 2023, whereas Fox’s working margin contracted from 20.3% to 18.5% over this era. Textron’s margin growth will be attributed to a greater value realization. Wanting on the final twelve-month interval, Fox’s working margin of 17.5% fares significantly better than 7.8% for Textron.

Taking a look at monetary danger, each firms are comparable. Textron’s 21% debt as a proportion of fairness is way decrease than 53% for Fox. Nevertheless, its 9% money as a proportion of property is decrease than 17% for Fox, implying that Textron has a greater debt place, however Fox has extra cash cushion.

4. The Internet of It All

We see that Fox has seen higher income progress, is extra worthwhile, and has extra cash cushion, whereas Textron has a greater debt place. Now, taking a look at prospects, we imagine FOX is the higher selection of the 2. We estimate Textron’s Valuation to be $100 per share, reflecting an upside of round 15% from its present ranges of round $86. Textron inventory trades at 1.2x trailing revenues, in comparison with 1.2x common during the last 4 years. In distinction, Fox inventory trades at 1.1x revenues, in comparison with 1.3x common during the last 4 years.

General, we predict FOXA is more likely to supply higher returns than TXT within the subsequent three years. Not solely does Fox have higher income progress and profitability, its prospects look strong, amid sturdy promoting progress. With upcoming occasions such because the Presidential election, Fox can look ahead to increased promoting progress.

Whereas FOXA could outperform TXT within the subsequent three years, it’s useful to see how Textron’s Friends fare on metrics that matter. You will see that different helpful comparisons for firms throughout industries at Peer Comparisons.

TXT Return In contrast with Trefis Bolstered Worth Portfolio

Make investments with Trefis Market Beating Portfolios

See all Trefis Value Estimates

-

News4 weeks ago

News4 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News4 weeks ago

News4 weeks agoMerry Christmas from Carrboro – by Thomas Mills

-

News4 weeks ago

News4 weeks agoSanta Cruz Wharf collapse leads 3 city workers to be rescued in California

-

News4 weeks ago

News4 weeks agoOlympic snowboarder Sophie Hediger dies in avalanche accident | Snowboarding

-

News3 weeks ago

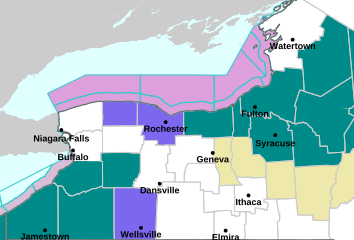

News3 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News3 weeks ago

News3 weeks agoOutstanding contributions by British nationals abroad recognised on the New Year 2025 Overseas and International Honours list

-

News4 weeks ago

News4 weeks agoChristopher Nolan’s next film announced as ‘mythic action epic’ The Odyssey | Movies