News

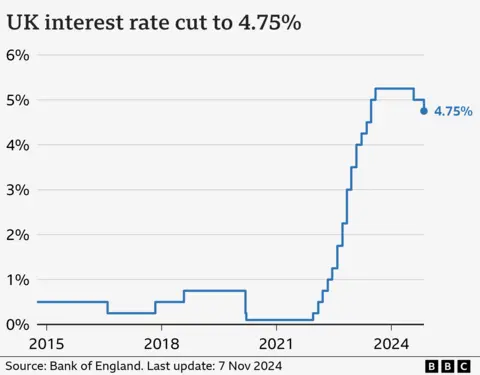

UK interest rates cut to 4.75% but Bank hints fewer falls to come

Getty Pictures

Getty PicturesUK rates of interest might take longer to fall additional after the Financial institution of England forecast that inflation will creep increased after final week’s Funds.

The Financial institution reduce rates of interest to 4.75% from 5% in a transfer that had been extensively anticipated.

But it surely indicated that whereas the additional spending outlined within the Funds would initially increase development, measures similar to elevating the cap on bus fares and VAT on non-public college charges would push costs up at a sooner fee.

Financial institution governor Andrew Bailey mentioned charges had been more likely to “proceed to fall step by step from right here”, however cautioned they might not be reduce “too shortly or by an excessive amount of”.

“The trail is downward from right here. We’ll see how shortly and by how a lot. I do emphasise the phrase gradual and the explanation for that’s there are loads of dangers on the market on this planet at massive and in addition domestically,” he instructed the BBC.

Traders now don’t count on any additional fee cuts this yr, with the Financial institution more likely to maintain charges at its subsequent assembly in December.

Capital Economics economist Paul Dales mentioned he now anticipated charges to fall slower to three.5% in early 2026 somewhat than to three%.

Inflation – which measures the tempo of value rises – fell under the Financial institution’s 2% goal within the yr to September, however was at all times anticipated to rise once more after gasoline and electrical energy costs rose final month.

It was then forecast to drop again to 2% by 2026, however the Financial institution now expects that to occur within the following yr.

The Financial institution’s fee setting physique – the Financial Coverage Committee – voted 8-1 in favour of the reduce.

Catherine Mann voted to maintain charges on maintain citing the affect of the Funds on inflation as one of many causes.

“The Financial institution of England has delivered yet one more reduce for the street, earlier than it’s extensively anticipated to close up store for some time and anticipate the mud to settle,” mentioned Sarah Coles, head of private finance at Hargreaves Lansdown.

“Extra borrowing within the Funds, a better nationwide residing wage and rises in employer Nationwide Insurance coverage contributions, have raised issues that inflation might make an unwelcome return,” she added.

Given this, the Financial institution is “cautious of slicing charges additional”, Ms Coles mentioned.

The slower tempo of fee cuts “means higher information for savers and people trying to find an annuity, however dangerous information for mortgage debtors”.

The Financial institution’s rate of interest closely influences the charges Excessive Road banks and different cash lenders cost clients for loans, in addition to bank cards.

Multiple million mortgage debtors on tracker and variable offers are more likely to see a direct fall of their month-to-month repayments.

Nonetheless, mortgage charges are nonetheless a lot increased than they’ve been for a lot of the previous decade.

The common two-year fastened mortgage fee is 5.4%, in accordance with monetary data firm Moneyfacts. A five-year deal has a mean fee of 5.11%.

The newest fee reduce means savers are seemingly see a discount within the returns supplied by banks and constructing societies. The present common fee for an easy accessibility account is about 3% a yr.

Chancellor Rachel Reeves, mentioned: “At this time’s rate of interest reduce can be welcome information for thousands and thousands of households, however I’m below no phantasm in regards to the scale of the problem going through households after the earlier authorities’s mini-budget.

“This authorities’s first Funds has set out how we’re taking the long-term choices to repair the foundations.”

Shadow chancellor Mel Stride mentioned the speed reduce could be welcomed by householders and “builds on the work the Conservatives did in workplace to carry inflation down”.

“Nonetheless, the unbiased OBR and the Financial institution of England set out that on account of Labour’s decisions within the Funds final week inflation can be increased,” he added.

‘Charge cuts hit our financial savings’

Claire Hopwood and Gavin Laking

Claire Hopwood and Gavin LakingClaire Hopwood and Gavin Laking have been constantly utilizing their financial savings accounts whereas they prepare to purchase their new home.

Gavin says it’s irritating how shortly rate of interest cuts can hit their financial savings.

“We’ve been having fun with a 4.5% fee on one in every of our accounts however that’s now dropped to three.9%.”

Claire says the upper rates of interest have been useful: “It’s cowl for emergencies. That’s all you are able to do, actually.”

Final week’s Funds included plans to borrow a further £28bn a yr, in addition to £40bn in tax-raising measures.

The largest measure is a rise in Nationwide Insurance coverage Contributions paid by employers.

Companies are anticipated to move on the price of increased Nationwide Insurance coverage prices to clients by elevating costs.

It might additionally lead to a slower tempo of wage rises for workers.

The Financial institution additionally revised up its development forecast for 2025 and steered that the speed of unemployment might fall sharply to 4.1% from 4.7%.

What are my financial savings choices?

- As a saver, you’ll be able to store round for the most effective account for you

- Loyalty usually does not pay, as a result of outdated financial savings accounts have among the many worst rates of interest

- Financial savings merchandise are supplied by a spread of suppliers, not simply the large banks

- The very best deal isn’t the identical for everybody – it will depend on your circumstances

- Greater rates of interest are supplied in case you lock your cash away for longer, however that won’t go well with everybody’s way of life

- Charities say it is very important attempt to maintain some financial savings, nevertheless tight your price range, to assist cowl any surprising prices

There’s a information to totally different financial savings accounts, and what to consider on the government-backed, unbiased MoneyHelper web site.

What are rates of interest? A fast information.

-

News4 weeks ago

News4 weeks agoFormer snooker world champion Terry Griffiths dies after ‘lengthy battle with dementia’ | UK News

-

News4 weeks ago

News4 weeks agoSunny Edwards retires after Galal Yafai earns dominant win

-

News4 weeks ago

News4 weeks agoHuge 50ft sinkhole appears on Merthyr housing estate as homes evacuated

-

News4 weeks ago

News4 weeks agoThe Madness Netflix release date, cast, trailer, plot: Everything to know | TV & Radio | Showbiz & TV

-

News4 weeks ago

News4 weeks agoThe Madness viewers all saying same thing about Colman Domingo in new Netflix thriller

-

News4 weeks ago

News4 weeks agoXRP Is Now The Fourth Largest Cryptocurrency After $100 Billion Post-Election Surge

-

News4 weeks ago

News4 weeks agoThe 121+ Best Black Friday Deals We’re Tracking Live

-

News4 weeks ago

News4 weeks agoMichael Fassbender ‘The Agency’ Interview on Martian’s Motivation and More