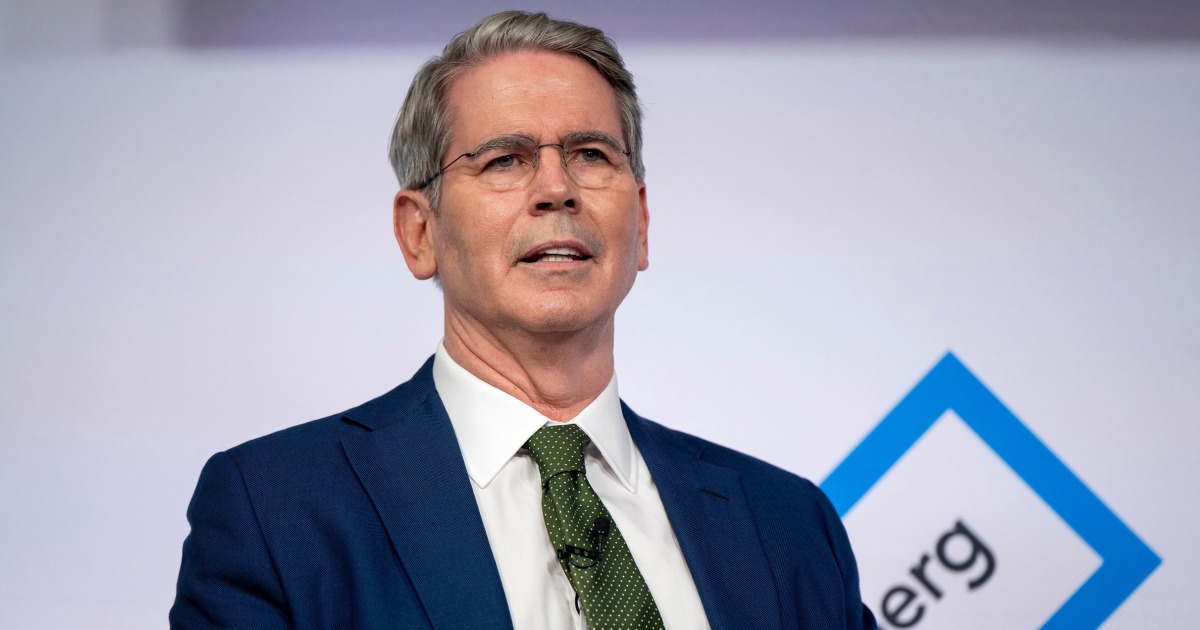

President-elect Donald Trump on Friday introduced he had requested Scott Bessent, a hedge fund government and high fundraiser to his marketing campaign, to function secretary of the Treasury Division.

In a press release concerning his decide, Trump stated that Bessent “will assist me usher in a brand new Golden Age for america.”

“Not like in previous Administrations, we are going to guarantee than no People can be left behind within the subsequent and Best Financial Increase, and Scott will lead that effort for me,” Trump stated.

“Scott will help my Insurance policies that can drive U.S. Competitiveness, and cease unfair Commerce imbalances, work to create an Economic system that locations Development on the forefront, particularly by our coming World Vitality Dominance,” he added. “Collectively, we are going to Make America Wealthy Once more, Affluent Once more, Inexpensive Once more, and most significantly, Nice Once more!”

Bessent was one in every of a slew of picks introduced by Trump on Friday night time alongside Russell Vought to move up the Workplace of Administration and Finances, Dr. Marty Makary for commissioner of the Meals and Drug Administration and others.

If confirmed by the Senate, Bessent will helm the fiscal insurance policies for an economic system that weathered excessive inflation in recent times, a problem that remained high of thoughts for a lot of voters who helped ship Trump again to the White Home within the election earlier this month.

Trump’s decide can be tasked with implementing any tax cuts {that a} Republican-controlled Congress could pursue. And with Trump proposing aggressive tariffs on imports from international locations spanning the globe, the brand new Treasury Division chief must handle relationships with world finance ministers who could select to retaliate with tariffs of their very own.

Bessent at present serves as chief government and chief funding officer on the New York-based hedge fund Key Sq. Capital Administration, which he based in 2015.

Earlier than establishing the hedge fund, Bessent was the highest funding officer for Soros Fund Administration, an funding agency that manages property for billionaire and liberal megadonor George Soros’ household and their foundations, from 2011 to 2015. Bessent additionally labored as managing associate of Soros Fund Administration’s London workplace from 1991 to 2000 and taught financial historical past as an adjunct professor at his alma mater, Yale College, from 2006 to 2010.

Throughout a Fox Enterprise interview after Trump spoke at on the Financial Membership of New York in September, Bessent was requested what he preferred most about Trump’s financial plan.

“I feel it’s the melding of financial coverage with nationwide safety. Financial coverage and nationwide safety are actually inseparable, and Donald Trump understands that,” Bessent stated on the time, including that Trump’s imaginative and prescient was “a formulation for independence and power and manufacturing, for getting our funds so as.”

Some Trump allies had frightened that Bessent was insufficiently supportive of the tariff agenda. He steered the tariff threats are a “maximalist” negotiating technique to safe higher free commerce offers, and he has expressed concern about flouting World Commerce Group guidelines.

He tried to handle considerations about his beliefs on tariffs with an op-ed in Fox Information late final week. He celebrated tariffs as a coverage instrument and as a income raiser, however he did emphasize utilizing them “strategically” — the identical language that President Joe Biden and the Democrats have used on tariffs, and seen by the protectionist wing as not sufficiently supportive of Trump’s objective of common baseline tariffs.

The Cupboard-level job is to steer federal fiscal insurance policies set by Congress and the White Home. The secretary can be the manager department’s high go-between with the Federal Reserve, a historically autonomous establishment that units financial insurance policies, equivalent to figuring out rates of interest and steering financial situations at a broader stage. That could possibly be a fragile activity within the incoming Trump administration, which is more likely to put unprecedented political strain on the central financial institution.

NBC Information reported earlier this week that Bessent was a high contender for treasury secretary.

Trump has spoken in glowing phrases about Bessent, calling him “probably the most good males on Wall Road” at a rally in August.

Throughout his time out and in of workplace, Trump, in contrast, has blasted Fed Chairman Jerome Powell, whom he nominated in 2017. In an October interview with Bloomberg Information, Trump stated the president shouldn’t be allowed to order rate of interest choices however ought to have the ability to “put in feedback as as to if the rates of interest ought to go up or down.”

Powell has stated he wouldn’t yield the place if Trump requested him to resign, which means he might in idea stay chairman till his time period expires in Could 2026. With inflation moderating over the previous 12 months, the Powell-led Fed has lower rates of interest as a part of a bid to cease excessive borrowing prices from unduly elevating unemployment.

In Trump’s first time period, he tapped banker Steven Mnuchin to steer the Treasury Division. Mnuchin, who additionally dabbled in Hollywood as a financier and producer, fumbled over some ethics guidelines firstly of his time period, touchdown himself briefly in scorching water for plugging a “Lego Batman” film that he executive-produced.

However his tenure on the Treasury Division was extra secure than these of different high-level Cupboard posts in Trump’s first time period. Mnuchin remained within the function for all 4 years, serving to steer the economic system by the onset of the pandemic by serving to to push the $2 trillion CARES Act towards bipartisan passage in March 2020.

The stimulus package deal, which most memorably included checks despatched on to households, was hailed by economists as a bridge that helped carry the U.S. over the worst financial turbulence from the pandemic and shutdown orders meant to fight it.

After Trump’s re-election, Mnuchin instructed CNBC he was unlikely to simply accept a brand new Cupboard function however would “be completely happy to serve from the skin.” Since leaving workplace, Mnuchin launched an funding fund that reportedly sourced its capital from sovereign wealth funds in a number of Gulf states.