News

Trading Begins At About $120 Per Share

Topline

Nvidia’s share worth is at its lowest stage since late 2022 after the corporate executed its beforehand introduced inventory break up, a procedural transfer symbolic of the bogus intelligence sensation and semiconductor chip designer’s astonishing inventory market run.

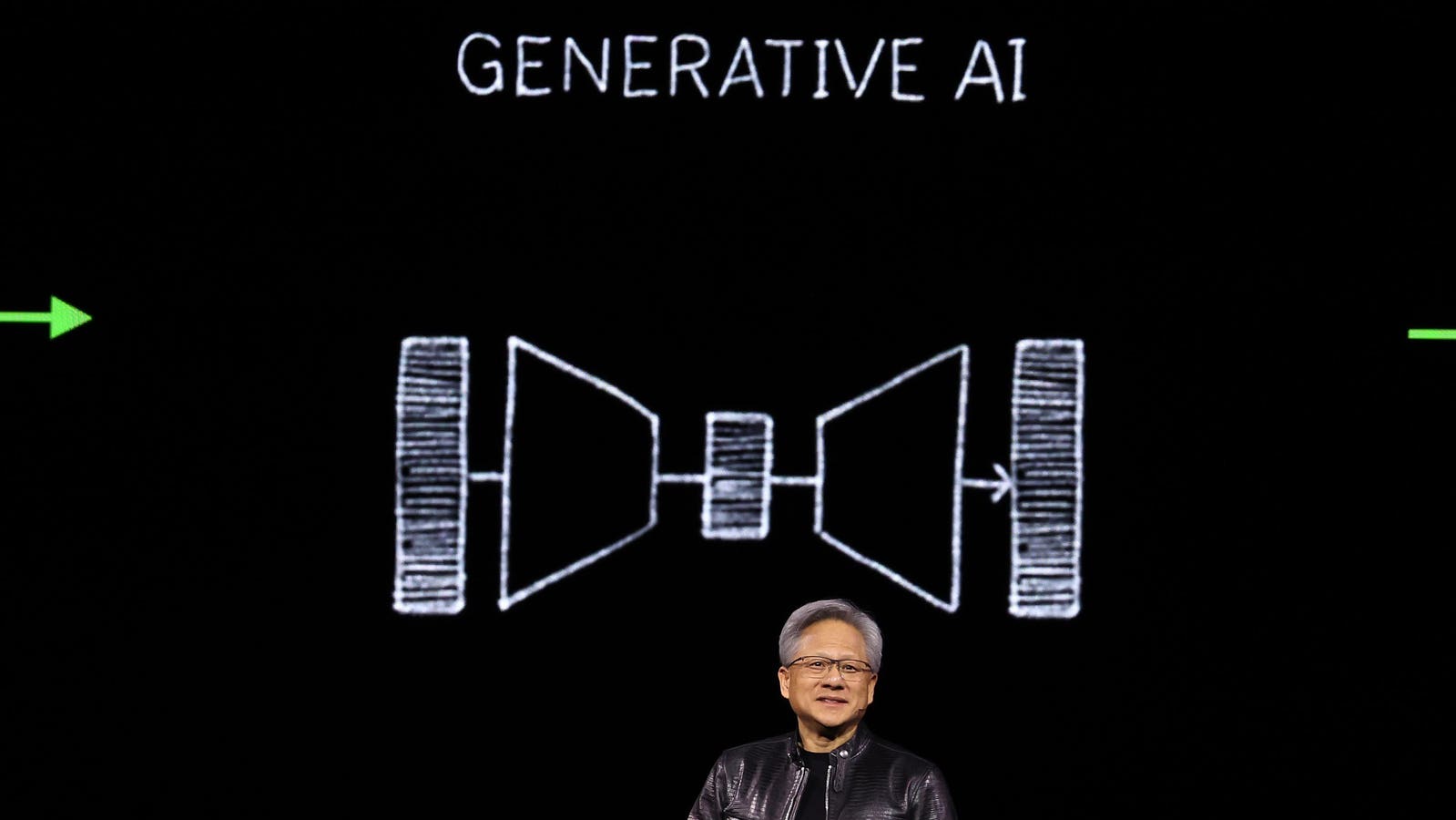

Nvidia CEO Jensen Huang delivers a keynote handle at his firm’s March generative AI convention.

Key Info

Monday was Nvidia’s first day of buying and selling after the corporate break up its shares on a 10-for-1 foundation based mostly on Friday’s closing share worth of $1,210, which means shareholders had been awarded 10 shares for every of their present shares, not diluting any fairness.

Nvidia shares opened Monday at about $120 per share after a modest dip, however are nonetheless inside 5% of its intraday, split-adjusted excessive of $125.59 recorded final week.

The inventory break up, a routine transfer for corporations whose share costs rose considerably, comes after Nvidia’s inventory market surge as traders poured into the agency arguably most well-positioned to revenue off of the AI revolution.

Get Forbes Breaking Information Textual content Alerts: We’re launching textual content message alerts so you may at all times know the largest tales shaping the day’s headlines. Textual content “Alerts” to (201) 335-0739 or enroll right here.

Shocking Reality

Nvidia’s inventory traded Monday on the identical unadjusted share worth it did in October 2022, which means 10 shares of the corporate 20 months in the past is price the identical as one share now after the corporate exploded from a sub-$300 billion market valuation to nearly $3 trillion, making Nvidia the third-largest firm on the earth.

Key Background

The self-appointed “engine of AI,” Nvidia most notably designs the {hardware} which shops the immense knowledge hundreds wanted for generative AI and the graphics processing models (GPUs) which deliver machine studying computing to life. During the last decade, Nvidia went from a little-discussed Silicon Valley firm price round $10 billion to the discuss of Wall Avenue, as its earnings exploded resulting from its market dominance in AI chips, with the likes of Amazon, Apple and Microsoft amongst its big-ticket clients. Thanks largely to the attention popping rally during the last two years with the AI increase, Nvidia inventory’s long-term chart seems downright foolish, with split-adjusted shares buying and selling at lower than $1 as lately as 2016. Nvidia was among the many 10 most costly S&P 500 parts by share worth at Friday’s shut, however is now in step with the S&P median of $118 per share. Nvidia has nearly single handedly boosted the S&P from its 2022 nadir to its document highs this 12 months resulting from its market-beating returns at its huge valuation.

Additional Studying

-

News4 weeks ago

News4 weeks agoWhen is Super Bowl 2025? See date, time and NFL playoff picture

-

News4 weeks ago

News4 weeks agoHere’s the 2025 Houston Rodeo lineup – Houston Public Media

-

News4 weeks ago

News4 weeks agoNotre Dame defeats Penn State in Orange Bowl thriller, advances to title game

-

News4 weeks ago

News4 weeks agoRichard Hammond announces split from wife Mindy after an ‘amazing 28 years’ | Ents & Arts News

-

News4 weeks ago

News4 weeks agoWho is Sutton Foster? Everything you need to know

-

News4 weeks ago

News4 weeks agoArsenal vs Manchester United LIVE: FA Cup result and final score as penalties settle chaotic clash

-

News4 weeks ago

News4 weeks agoWho is Tyler Young? Peterborough star ready for FA Cup fairytale against father Ashley Young

-

News4 weeks ago

News4 weeks agoFormer Hove MP arrested – Brighton and Hove News