News

This Game Is Rigged Against You

Nicely, right here we go once more. The rigged sport of meme-stock buying and selling is again in vogue, evidently. GameStop (NYSE:GME) inventory merchants deserve the credit score or, maybe, the blame for this. I received’t win any reputation contests for this, however I’m bearish on GME inventory and count on this mania part to finish badly, similar to it did after the 2021 hype cycle (see the chart under).

If anyone cares anymore, GameStop sells bodily copies of video video games and, to a lesser extent, digital copies of video games. Usually talking, at present’s players straight obtain or stream their video video games as an alternative of buying them by GameStop.

The issue is that monetary merchants have notoriously brief consideration spans – however you don’t should fall into that lure. I sincerely hope that this message reaches you earlier than you commit your hard-earned capital to GameStop inventory, solely to most likely find yourself regretting it afterward.

GameStop: The Uncommon Motive for the Rally

As I’ll describe in just a few moments, Wall Avenue’s analysts barely cowl GameStop (and the one Wedbush analyst masking GameStop undoubtedly isn’t bullish). That’s as a result of seasoned traders don’t take the corporate very severely. Nonetheless, GameStop inventory – I imply the inventory, not the corporate itself – garnered plenty of consideration in 2021. Quick-forward to Might 13, 2024, and the unique meme inventory of the 2020s is top-of-mind as soon as once more.

As lined by TipRanks contributor Shrilekha Pethe, in addition to by Bloomberg and others, GME inventory unexpectedly zoomed larger on Monday, even doubling in value at round 10:00 a.m. Jap time. Because of Pethe’s reporting, I shortly realized that there weren’t any company-prompted catalysts on Might 13, similar to an earnings report or an announcement from GameStop’s CEO, Ryan Cohen.

As an alternative, the occasion that bought meme-stock merchants excited was a posting from “Roaring Kitty,” or @TheRoaringKitty, on social-media platform X. Beforehand a prolific Reddit person and meme-stock guru, “Roaring Kitty” posted on X on Monday, and this was his first X or Reddit posting because the peak of stock-market speculative fervor in 2021.

Judging from his X posting, it seems like “Roaring Kitty” didn’t have a lot to say, because the publish was simply a picture of a online game participant sitting in an upright place in a chair. Is he suggesting that he’s now sitting up and taking note of one thing after a prolonged absence?

GameStop: It’s All FOMO and YOLO

For what it’s value, there’s no denying that “Roaring Kitty” has some clout within the on-line buying and selling group. Judging by Monday’s beautiful surge in GME inventory, it’s clear that meme-stock merchants haven’t misplaced their sense of FOMO (worry of lacking out) and YOLO (you solely dwell as soon as).

Monetary Insyghts President Peter Atwater succinctly summed up the still-considerable affect of “Roaring Kitty” and the implications of Monday’s obvious meme-stock revival.

“That he’s in a position to generate a crowd says that the group is again to feeling FOMO and YOLO in an infinite approach… When individuals dive into issues which might be of pure speculative worth, their confidence is extraordinarily excessive and this is without doubt one of the ways in which it manifests,” Atwater defined.

The important thing phrase right here is “pure speculative worth.” With TipRanks’ instruments at my disposal, I can instantly discern that GameStop isn’t on rock-solid floor on the subject of the corporate’s fundamentals.

The GameStop financials web page is especially helpful right here. Because it seems, the corporate has destructive free money move (FCF) and roughly $600 million in complete debt.

Moreover, on the GameStop earnings web page, I found that Wall Avenue’s consensus forecast requires the corporate to flip from an adjusted revenue in This autumn 2023 to an adjusted loss in Q1 2024. Solely time will inform whether or not GameStop really misplaced cash within the first quarter, because the firm is predicted to launch its earnings report on June 5.

But, keen meme-stock merchants have already pumped up the GameStop share value previous to the earnings report. Now, GameStop has the unenviable burden of getting to justify its sky-high share value – similar to in 2021, and that story didn’t finish properly in 2022, 2023, and early 2024.

To complete this cautionary be aware, I’ll defer to the knowledge and expertise of Giacomo Pierantoni, head of information at Vanda Analysis. He warned, “These surges in retail exercise have served as contrarian indicators, prompting institutional traders to shortly brief the inventory following these rallies pushed by retail traders.” So, would you somewhat be on the facet of the retail crowd or the large-scale whales?

Is GameStop Inventory a Purchase, In keeping with Analysts?

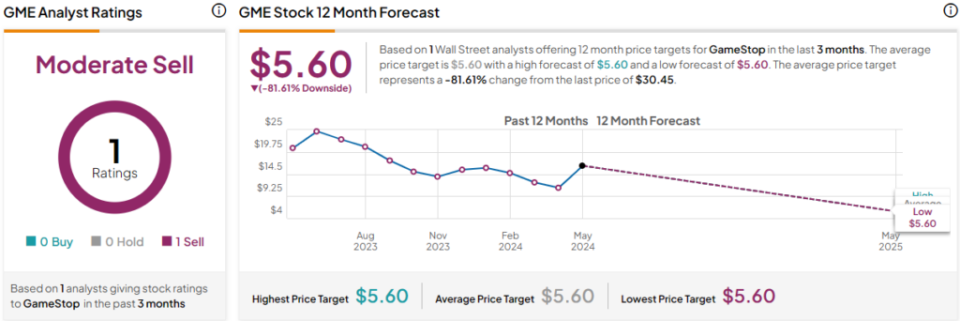

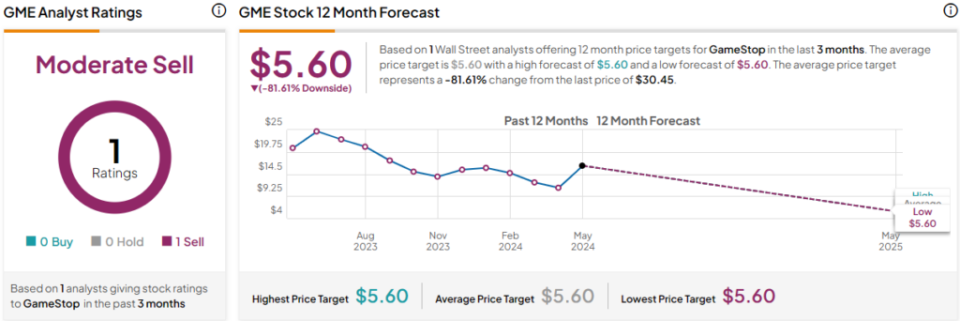

On TipRanks, GME is available in as a Average Promote based mostly on one Promote score assigned previously three months. GameStop inventory’s value goal is $5.60, implying 81.6% draw back potential.

Conclusion: Ought to You Think about GameStop Inventory?

The unusual surge in GameStop inventory is likely to be a “contrarian sign,” to borrow a phrase from Pierantoni. Nonetheless, I don’t advocate attempting to fade at present’s transfer and short-sell the inventory. That’s simply asking for hassle.

However, severe traders ought to suppose lengthy and onerous about GameStop’s fundamentals. The corporate has to cope with weak client spending and powerful competitors. Brief-term merchants would possibly ignore the purple flags, however I consider you shouldn’t. All in all, the sport is rigged in opposition to traders who chase GME inventory in hopes of long-term features, and I’m undoubtedly not contemplating shopping for any shares at present.

Disclosure

-

News4 weeks ago

News4 weeks agoHow to watch the 2024 Macy’s Thanksgiving Day Parade and who’s performing

-

News3 weeks ago

News3 weeks agoFormer snooker world champion Terry Griffiths dies after ‘lengthy battle with dementia’ | UK News

-

News3 weeks ago

News3 weeks agoSunny Edwards retires after Galal Yafai earns dominant win

-

News3 weeks ago

News3 weeks agoHuge 50ft sinkhole appears on Merthyr housing estate as homes evacuated

-

News4 weeks ago

News4 weeks agoThe Madness Netflix release date, cast, trailer, plot: Everything to know | TV & Radio | Showbiz & TV

-

News4 weeks ago

News4 weeks agoThe Madness viewers all saying same thing about Colman Domingo in new Netflix thriller

-

News3 weeks ago

News3 weeks agoHow to watch, stream | Eagles vs. Ravens

-

News3 weeks ago

News3 weeks agoXRP Is Now The Fourth Largest Cryptocurrency After $100 Billion Post-Election Surge