News

Stocks Tick Up as Oil, Treasury Yields Retreat; Indian Stocks Tumble

Inventory Indexes Wrap: Cruise Shares, REITs Lead S&P 500 Greater; Development, Oil Shares Lag

June 04, 2024 04:23 PM EDT

The Dow

Cisco (CSCO) gained 1.7% after it launched a $1 billion fund to put money into synthetic intelligence startups.

Different tech shares gained, together with Microsoft (MSFT) and Amazon (AMZN), each up 0.6%.

Intel (INTC) slipped 0.9% after unveiling its next-generation AI information heart chips.

The S&P 500

Cruise operators led the index. Carnival Corp (CCL) rose 5.8%, adopted by Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean (RCL), up 4% and a pair of.8%, respectively.

Actual property funding trusts had been additionally among the many index’s greatest performers on Tuesday. Further House Storage (EXR) superior 2.2% and Realty Earnings Company (O) gained 2.1%.

Nvidia (NVDA) rose 1.3% to shut at one other report excessive.

Tub & Physique Works (BBWI) plummeted 13.3% after its current-quarter steerage fell in need of Wall Avenue’s estimates.

Mining big Freeport-McMoRan (FCX) fell 4.5% as copper and silver costs continued to fall from current highs.

Yesterday’s weak building and manufacturing information continued to weigh on industrial suppliers. Mohawk Industries (MHK) fell 4.5%, whereas Builders FirstSource (BLDR) and Stanley Black & Decker (SWK) every slid 3.7%.

Falling oil costs weighed on vitality shares. Halliburton (HAL) fell 2.5% and ExxonMobil (XOM) shed 1.5%.

The Nasdaq 100

Meals and beverage shares gained floor. PepsiCo (PEP) added 1.6% and Kraft Heinz (KHC) rose 1.5%.

Semiconductor shares had been largely decrease. Marvell Expertise (MRVL) misplaced 2.7% and Superior Micro Units (AMD) slipped 2.2%.

CrowdStrike (CRWD) fell 1% forward of its quarterly outcomes after the bell.

Tesla (TSLA) shed 0.9% amid stories Elon Musk had diverted Nvidia chips ordered for the electrical car maker to his social media platform X and his synthetic intelligence start-up xAI.

GameStop, AMC Rally Fades Amid Experiences E*Commerce Is Contemplating Banning Keith Gill

June 04, 2024 03:35 PM EDT

Monday’s rally in GameStop (GME) and AMC Leisure (AMC) light Tuesday following a report that Keith Gill, one of many key figures behind the meme inventory rallies, could also be barred from on-line buying and selling platform E*Commerce.

Current inventory swings fueled by Gill’s social media posts raised considerations at Morgan Stanley’s (MS) E*Commerce that Gill could possibly be able to manipulating inventory costs for his personal profit, the Wall Avenue Journal reported Monday night.

Sunday evening, a Reddit account belonging to Gill posted a screenshot of a portfolio indicating he owned 5 million GameStop shares price over $115 million on the time of the screenshot. GameStop shares rocketed larger on Monday morning, practically doubling in worth earlier than narrowing to a 21% achieve by the point markets closed.

Shares turned decrease Tuesday, and had been down 3.5%, although regardless of Tuesday’s losses, GameStop shares have surged practically 60% since Gill reappeared on-line final month after an prolonged absence of practically three years.

Different meme shares like AMC and Tupperware Manufacturers (TUP) additionally rose Monday, whereas BlackBerry (BB) climbed earlier than ending Monday flat. All three shares had been decrease Tuesday afternoon, with AMC shares down 0.9%, BlackBerry 2.9% decrease, and Tupperware dropping 4.4%.

–Aaron McDade

Carnival Inventory Features on Plan To Consolidate Australia Operations

June 04, 2024 02:39 PM EDT

Shares of Carnival Corp (CCL) surged on Tuesday after the cruise operator mentioned it might sundown its P&O Cruises Australia model and fold its Australian operations into Carnival Cruise Line.

The change will go into impact in March 2025, and end result within the switch of two P&O-branded vessels to the corporate’s flagship Carnival model. One ship, the Pacific Explorer, will likely be retired in February 2025.

“Regardless of growing Carnival Cruise Line’s capability by nearly 25% since 2019 together with transferring three ships from Costa Cruises, visitor demand stays extremely robust so we’re leveraging our scale in an much more significant method by absorbing a complete model into the world’s hottest cruise line,” CEO Josh Weinstein mentioned in an announcement.

Cruise operators have benefited from robust journey demand that has largely continued after an preliminary post-pandemic surge. However their share costs haven’t saved tempo. Carnival inventory remains to be price lower than half what it was earlier than March 2020, even after rallying within the first half of final 12 months.

Shares had been up greater than 5% Tuesday afternoon, making Carnival one of many S&P 500’s best-performing shares. Opponents Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean (RCL) had been additionally among the many index’s high shares. Nonetheless, Carnival shares have misplaced 9% of their worth thus far this 12 months.

Google, Microsoft Reportedly Make Job Cuts in Newest Hit To Tech Business

June 04, 2024 01:51 PM EDT

The pattern of tech layoffs is constant into June as lots of of jobs have reportedly been minimize at Microsoft (MSFT) and Alphabet’s (GOOGL) Google in current days.

Tech had essentially the most job cuts of any sector within the first quarter, in keeping with a Challenger, Grey & Christmas report, with Google and Microsoft conducting layoffs together with different giants like Amazon (AMZN), as firms targeted on synthetic intelligence (AI) initiatives and pulled again on different investments.

Layoffs reportedly have hit Google’s Cloud division, which noticed sizable progress within the tech big’s most up-to-date earnings report. A minimum of 100 positions have been minimize throughout a number of completely different Cloud groups during the last week, in keeping with stories from Enterprise Insider and CNBC.

Microsoft can be reducing jobs this week, with an estimated 1,000 jobs affected throughout its cloud-based Azure groups, in addition to these engaged on the corporate’s HoloLens 2 blended actuality headsets, in keeping with current stories from Enterprise Insider, CNBC, and The Verge.

Microsoft shares had been little modified Tuesday afternoon, whereas Alphabet inventory dipped 0.5%.

–Aaron McDade

Intel Inventory in Focus After Firm Reveals Subsequent-Gen AI Knowledge Heart Chips

June 04, 2024 12:51 PM EDT

Intel (INTC) revealed its newest processors on Tuesday, because the chipmaker goals to seize market share from rivals within the booming synthetic intelligence (AI) information heart market.

Intel unveiled the Xeon 6 information heart chips on the Computex commerce honest in Taipei alongside different main chipmakers. The following-generation chips are available two varieties: a extra highly effective processor to deal with the workload of bigger AI infrastructure necessities, and an effectivity mannequin, which the corporate has positioned as a alternative for earlier-generation chips.

Intel mentioned the effectivity Xeon chip will likely be accessible for supply on Tuesday, however famous that the higher-powered processor received’t be shipped till the third quarter of this 12 months. It additionally intends to launch further iterations of the chips in 2025.

Zooming out to the weekly chart, Intel shares broke down under the decrease trendline of an ascending channel and the 50-day shifting common in early April, with declines accelerating into early Might. Extra not too long ago, the worth has consolidated inside a pennant, a chart sample that signifies a continuation of the present longer-term downtrend.

If the inventory strikes decrease from these ranges, buyers ought to monitor how the worth responds to its late February low at $24.73. A failure from consumers to defend this degree might see the downtrend revisit key multi-year help round $19.50, which at the moment sits 36% under Monday’s $30.29 closing worth.

Intel shares gained floor in pre-market buying and selling however had been down 0.7% in early afternoon buying and selling on Tuesday.

–Tim Smith

WTI Oil Sinks to Multi-Month Low Amid Issues Over Voluntary OPEC+ Cuts

June 04, 2024 11:54 AM EDT

West Texas Intermediate (WTI), a proxy for U.S. oil costs, prolonged its declines Tuesday after hitting a near-four-month low on Monday as buyers fretted over a fancy Group of the Petroleum Exporting International locations and allies (OPEC+) choice on Sunday that left the door open for voluntary cuts to be regularly unwound.

Whereas the Saudi-led cartel opted to increase most of its manufacturing cuts, which at the moment quantity to a mixed 3.66 million barrels barrels per day, till the tip of 2025, it additionally agreed to voluntary cuts from eight members to be regularly unwound from October.

In keeping with analysts, the settlement to part out reductions places downward stress on oil costs because it offers OPEC+ members appreciable leeway to ramp up output relying on market situations regardless of sluggish international demand stemming from excessive rates of interest and inflation.

The WTI worth has remained largely rangebound since December 2022, with neither the bulls nor bears capable of achieve the ascendency. Extra not too long ago, the commodity has damaged down from a broadening formation located slightly below the 200-day shifting common.

Trying forward, buyers ought to control the vary between $71.50 and $67.50 amid additional declines, an space the place the worth finds a zone of help from a sequence of worth actions over the previous 17 months. If the WTI worth enters this chart area, monitor for indicators of a reversal, corresponding to a hammer candlestick or bullish engulfing sample, which might sign a shift in investor sentiment.

–Tim Smith

Tub & Physique Works Slides Regardless of Earnings Beat as Steering Disappoints

June 04, 2024 10:34 AM EDT

Shares of retailer Tub & Physique Works (BBWI) slid in early buying and selling Tuesday regardless of a first-quarter earnings report that surpassed analyst expectations and the corporate’s personal steerage.

Internet gross sales slipped lower than 1% year-over-year to $1.38 billion, simply above analyst expectations of $1.37 billion, in keeping with estimates compiled by Seen Alpha. Revenue rose 7% to $87 million, or 38 cents per share, higher than the $72.4 million and 32 cents per share analysts had anticipated. In steerage launched in its earlier quarterly report, Tub & Physique Works had projected a first-quarter gross sales decline of two% to 4.5%, with EPS anticipated between 28 cents to 33 cents.

The retailer additionally lifted the ground of its steerage ranges for the total fiscal 12 months, projecting internet gross sales to vary from a 2.5% decline to flat from the 2023 mark of $7.43 billion, whereas EPS is anticipated between $3.05 to $3.35, down from final 12 months’s $3.84 determine.

For the second quarter, Tub & Physique Works initiatives gross sales to vary from a 2% drop to flat in comparison with final 12 months’s $1.56 billion, whereas analysts venture $1.54 billion. The retailer guided EPS from 31 cents to 36 cents, with the highest of that vary matching the quantity analysts anticipate.

Shares in Tub & Physique Works fell 7.3%, placing their positive aspects for the 12 months at 7%.

–Aaron McDade

Inventory Futures Fall

June 04, 2024 08:59 AM EDT

Dow futures had been down 0.4% in premarket buying and selling Tuesday.

S&P futures had been down 0.4%.

Nasdaq futures had been down 0.2%.

-

News4 weeks ago

News4 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News4 weeks ago

News4 weeks agoMerry Christmas from Carrboro – by Thomas Mills

-

News4 weeks ago

News4 weeks agoSanta Cruz Wharf collapse leads 3 city workers to be rescued in California

-

News4 weeks ago

News4 weeks agoOlympic snowboarder Sophie Hediger dies in avalanche accident | Snowboarding

-

News3 weeks ago

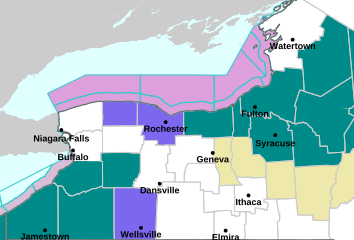

News3 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News3 weeks ago

News3 weeks agoOutstanding contributions by British nationals abroad recognised on the New Year 2025 Overseas and International Honours list

-

News4 weeks ago

News4 weeks agoBillionaire Vivek Ramaswamy is a Wall Street speculator accused of pump-and-dump schemes, not a scientist