News

Nike CEO John Donahoe under fire from Wall Street after Q424 report

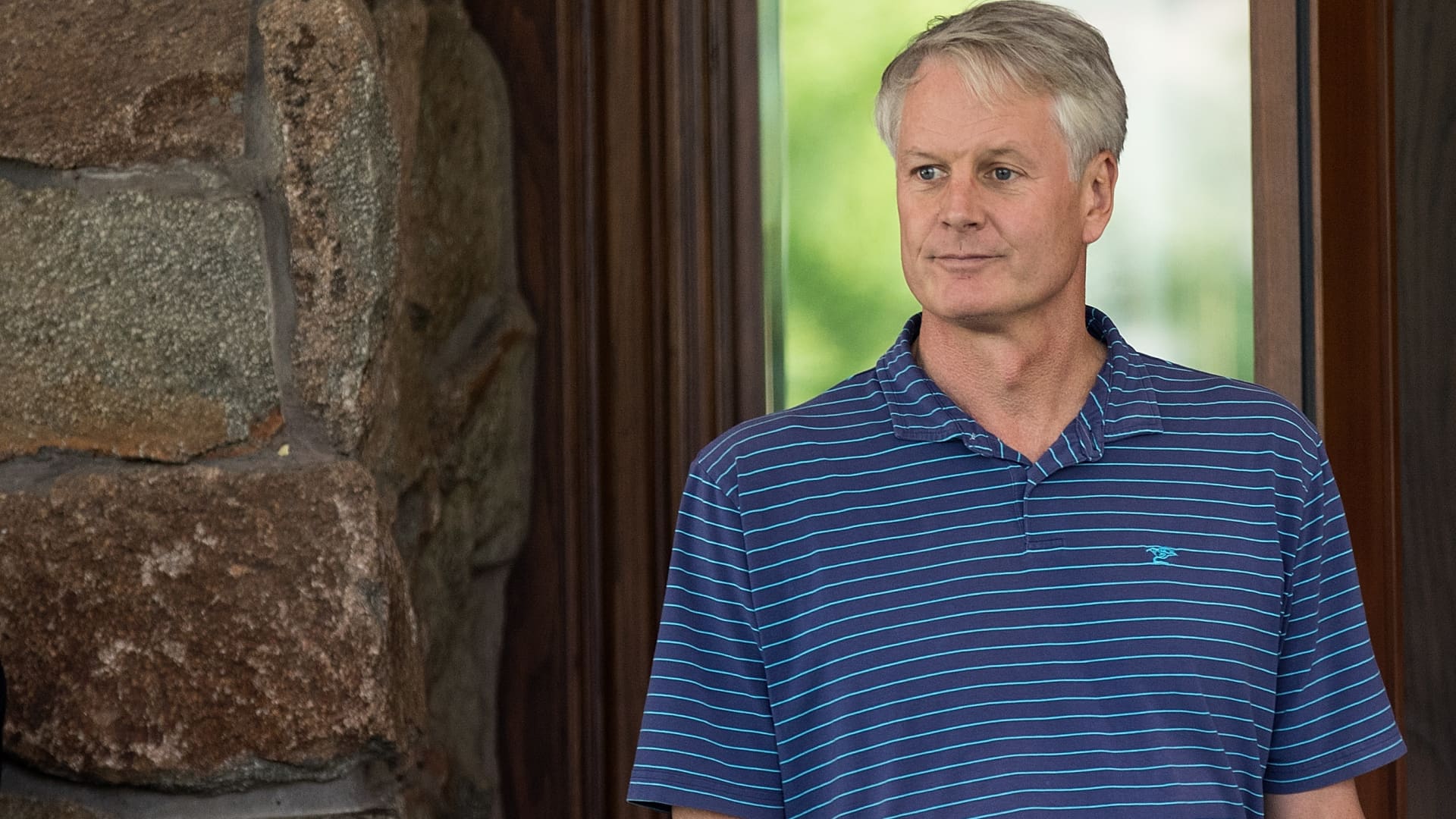

John Donahoe, attends the primary day of the annual Allen & Firm Solar Valley Convention, in Solar Valley, Idaho.

Drew Angerer | Getty Pictures

Nike CEO John Donahoe seems to be on skinny ice.

The previous high govt of eBay, who has been on the helm of Nike since January 2020, is beginning to lose Wall Road’s confidence after the corporate capped off a lackluster fiscal 12 months with extra unhealthy information.

On Thursday, Nike warned that gross sales in its present quarter have been anticipated to say no by a staggering 10% – far worse than the three.2% drop LSEG had projected – after it posted its slowest annual gross sales acquire in 14 years, excluding the Covid-19 pandemic.

The corporate additionally stated it expects fiscal 2025 gross sales to be down mid-single digits when it beforehand anticipated them to develop.

The warning indicators led shares to shut 20% decrease on Friday — making it the worst buying and selling day within the firm’s historical past since its IPO in Dec. 1980. The plunge wiped about $28 billion off of Nike’s market cap, bringing it to simply underneath $114 billion from $142 billion a day earlier.

As Wall Road digested the dismal outlook from the world’s largest sportswear firm, at the very least six funding banks downgraded Nike’s inventory. Analysts at Morgan Stanley and Stifel took it a step additional, particularly calling the corporate’s administration into query.

“The FY25 information (the fifth downward consensus revision in 6 quarters), pushes prospects for progress inflection additional into 2025 (maybe FY4Q or spring ’25 on the earliest) asking traders to each underwrite success of not but confirmed kinds and look throughout an unsure shopper discretionary backdrop into 2HCY24 till momentum may construct once more into 2HCY25,” wrote Stifel analyst Jim Duffy. “Administration credibility is severely challenged and potential for C-level regime change provides additional uncertainty.”

Nike inventory has underperformed the S&P 500 throughout CEO John Donahoe’s tenure.

Since Donahoe took over as Nike’s high govt, its inventory is down greater than 25% as of Friday’s shut, considerably underperforming each the S&P 500 and the XRT – the retail-focused ETF – which noticed features of round 67% and 66% in that point interval, respectively.

Nike finance chief Matt Pal on Thursday attributed the steering reduce to a number of things. Some, like softness in China and difficult international change headwinds, are exterior of Nike’s management, however others are issues it squarely created underneath Donahoe’s management.

The corporate is anticipating wholesale orders to be sluggish because it scales new kinds, pulls again on traditional franchises and works to restore its relationships with key retail companions after spending the previous few years slicing them off in favor of a direct-selling technique.

On the identical time, loyal clients who store on Nike’s web site are now not springing for brand new pairs of Air Power 1s, Air Jordan 1s or Dunks, the corporate’s core franchises. Critics say the sneaker strains have dominated the retailer’s choices for too lengthy and turned clients away as they sought recent kinds and revolutionary designs from a slew of upstart rivals.

That is left Nike to win again a few of its most important clients – runners. Because the retailer targeted on its direct-selling technique on the expense of innovation, scrappy rivals like On Operating and Hoka snatched up market share.

“It was nearly foolish in direction of the top of the decision they talked about working being such a key sport that customers are participating in. … We have recognized that for a very long time, we have recognized that the patron modified their thoughts post-pandemic, how they are much extra energetic,” Jessica Ramírez, senior analysis analyst at Jane Hali & Associates, advised CNBC, including a administration change at Nike is “fairly wanted.”

“Publish-lockdown, we noticed that the patron did undertake working and was severe about that and there was an on a regular basis runner, and Nike did not actually reply to that,” she stated. “I believe when you could have administration lacking key shopper shifts, there’s an issue along with your firm … one thing modified and so they’ve missed the mark.”

Kevin McCarthy, a senior analysis analyst at Neuberger Berman, advised CNBC’s Scott Wapner on Thursday that the corporate wants a change in administration and speculated that Donahoe’s employment contract may quickly expire.

“Every little thing that you have urged is flawed with this firm appears to circulation again to execution, administration and all the things else,” McCarthy stated on CNBC’s “Closing Bell.”

“They have a pair inner candidates proper now which can be very succesful … you have obtained a pair ex-Nike candidates, too, which were within the dialogue, and then you definately additionally produce other rivals which were mentioned. However I do assume that it is assumed that the management of this firm will probably be altering over the following six months.”

In equity to Donahoe, the Covid-19 pandemic began in earnest within the U.S. lower than two months into his tenure, and he is needed to grapple with shuttered shops, distant staff and a roller-coaster experience of shifting shopper preferences and skills.

Whereas the corporate’s inventory could also be down, Nike’s annual gross sales have grown some 37% underneath his management from $37.4 billion in fiscal 2020 to $51.36 billion in fiscal 2024.

Should you ask Phil Knight, Nike’s founder and its chairman emeritus, Donahoe is doing simply high quality.

“I’ve seen Nike’s plans for the long run and wholeheartedly imagine in them,” the 86-year-old advised CNBC in an announcement. “I’m optimistic in Nike’s future and John Donahoe has my unwavering confidence and full assist.”

-

News4 weeks ago

News4 weeks ago‘No Good Deed’ Recap, Episode 6: ‘Full Disclosure’

-

News4 weeks ago

News4 weeks agoChelsea 2 – 1 Brentford

-

News2 weeks ago

News2 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoHow India’s Gukesh Dommaraju became chess king in a cricket crazy country | Explainer News

-

News3 weeks ago

News3 weeks agoPeter Mandelson to be announced as UK’s next US ambassador | Peter Mandelson

-

News4 weeks ago

News4 weeks agoThe Wanted star Max George to spend Christmas in hospital to undergo surgery

-

News3 weeks ago

News3 weeks agoInstant analysis | Commanders survive Saints, get to 9-5 with 20-19 win

-

News3 weeks ago

News3 weeks ago‘Yellowstone’ Series Finale Watched By 11.4 Million Viewers Live