News

Keir Starmer denies budget to blame for rise in mortgage rates | Keir Starmer

Keir Starmer has conceded he was disenchanted within the UK development figures final week, however denied that his authorities’s price range was answerable for a current rise in mortgage charges.

The prime minister advised journalists travelling to the G20 summit in Rio: “What we now have carried out with the price range is to stabilise the financial system and that, for my part, was the important first step.

“Because of that, the forecasts are for rates of interest to go down, inflation to go down – you noticed the figures across the price range,” he mentioned, including that mortgage charges had been “particular person choices for the banks, however the rates of interest will likely be coming down”.

A string of excessive road lenders have pushed up mortgage charges modestly in current days amid expectations of upper inflation. Barclays has elevated some fixed-rate offers by as a lot as 0.56 share factors.

Within the forecasts revealed alongside final month’s price range, the unbiased Workplace for Price range Duty (OBR) mentioned it anticipated inflation to choose as much as 2.6% in 2025, “partly because of the direct and oblique influence of price range measures”.

Economists say this greater forecast for inflation – ensuing from stronger-than-expected authorities spending – has been one issue pushing up borrowing prices.

The chancellor, Rachel Reeves, used her price range to announce a £70bn enhance in public spending, to repair crumbling public companies and put money into infrastructure.

“It’s a giant loosening, and that can include sooner development, greater inflation and better rates of interest,” mentioned James Smith, a analysis director on the Decision Basis, a thinktank.

The Financial institution of England continues to be anticipated to proceed reducing rates of interest from their present degree of 4.75%, however at a barely slower tempo than specialists had been projecting earlier than the price range.

The shadow chancellor, Mel Stride, attacked Starmer for denying accountability for mortgage charges. “On the finish of the day, his authorities’s selections will result in rates of interest staying greater for longer, punishing 1000’s of hard-working households with mortgages for years to come back,” he mentioned. “Labour’s determined spin doesn’t change that actuality.”

The strikes in mortgage offers in current days are dwarfed by the sharp leap within the wake of Liz Truss’s mini-budget, nevertheless.

When bond yields elevated after Reeves’s price range, the chief secretary to the Treasury, Darren Jones, steered the UK nonetheless had “PTSD from Liz Truss”.

Economists stress authorities coverage is much from the one issue lifting mortgage charges, with uncertainty concerning the influence of Donald Trump’s insurance policies additionally weighing on markets’ minds.

“International charges have been going up – within the US, the UK and elsewhere as effectively,” Smith mentioned. “It’s the Trump impact as a lot as something. The price range response is smaller than that – however it pushes it in an identical course.”

Echoing the chancellor’s response to final week’s GDP figures, which confirmed development slowing to simply 0.1% within the three months to September, the prime minister mentioned it was “not ok, they’re not passable – I need to go additional than that.”

He mentioned: “That’s why we’re working so arduous to get the funding we’d like into the nation. However step one is to stabilise the financial system. Do I need higher development? Sure, I do. I don’t suppose that’s passable and we will likely be ensuring that determine improves.”

Some enterprise teams have steered the prolonged interval of uncertainty between July’s basic election and October’s tax-raising price range broken confidence over the summer season and contributed to the GDP slowdown.

The Financial institution of England governor, Andrew Bailey, will likely be questioned by MPs on the cross-party Treasury choose committee on Tuesday and is predicted to be requested concerning the influence of the price range on Financial institution coverage.

Bailey induced a stir final week when he waded into the controversy concerning the influence of Brexit, saying it was “weighing” on the UK financial system and urging the federal government to strike up a more in-depth relationship with the EU.

The outlook for the worldwide financial system has been clouded considerably by the election of Trump, who plans to impose tariffs – import taxes – on all overseas items flowing into the US.

-

News4 weeks ago

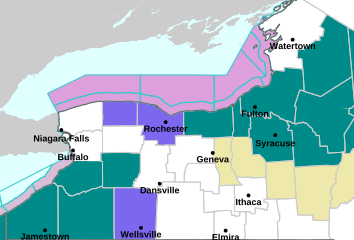

News4 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News4 weeks ago

News4 weeks agoThe Vivienne: RuPaul’s Drag Race UK and musical theatre star dies aged 32

-

News3 weeks ago

News3 weeks agoWhen is Super Bowl 2025? See date, time and NFL playoff picture

-

News4 weeks ago

News4 weeks agoApple Siri Eavesdropping Payout — Here’s Who’s Eligible And How To Claim

-

News3 weeks ago

News3 weeks agoMainoo ‘unhappy’ as Ratcliffe’s stance on three shock exits surfaces after U-turn

-

News3 weeks ago

News3 weeks agoNotre Dame defeats Penn State in Orange Bowl thriller, advances to title game

-

News4 weeks ago

News4 weeks agoReport: Leeds United 1-1 Blackburn Rovers

-

News3 weeks ago

News3 weeks agoCanadian PM Justin Trudeau may quit within days, say media reports