News

ITV plc (LON:ITV) Stock’s Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?

With its inventory down 1.3% over the previous week, it’s straightforward to ignore ITV (LON:ITV). Nonetheless, inventory costs are often pushed by an organization’s financials over the long run, which on this case look fairly respectable. Significantly, we will probably be listening to ITV’s ROE at this time.

Return on Fairness or ROE is a take a look at of how successfully an organization is rising its worth and managing buyers’ cash. Put one other approach, it reveals the corporate’s success at turning shareholder investments into income.

View our newest evaluation for ITV

How Do You Calculate Return On Fairness?

The system for return on fairness is:

Return on Fairness = Internet Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, primarily based on the above system, the ROE for ITV is:

22% = UK£426m ÷ UK£1.9b (Primarily based on the trailing twelve months to June 2024).

The ‘return’ is the yearly revenue. So, because of this for each £1 of its shareholder’s investments, the corporate generates a revenue of £0.22.

What Has ROE Received To Do With Earnings Development?

Thus far, we have discovered that ROE is a measure of an organization’s profitability. Primarily based on how a lot of its income the corporate chooses to reinvest or “retain”, we’re then capable of consider an organization’s future capability to generate income. Assuming all the pieces else stays unchanged, the upper the ROE and revenue retention, the upper the expansion charge of an organization in comparison with corporations that do not essentially bear these traits.

A Facet By Facet comparability of ITV’s Earnings Development And 22% ROE

To start with, ITV has a reasonably excessive ROE which is fascinating. Moreover, the corporate’s ROE is greater in comparison with the business common of 11% which is sort of exceptional. As you would possibly anticipate, the 4.4% internet revenue decline reported by ITV does not bode nicely with us. We reckon that there could possibly be another elements at play right here which can be stopping the corporate’s development. These embrace low earnings retention or poor allocation of capital.

Nonetheless, once we in contrast ITV’s development with the business we discovered that whereas the corporate’s earnings have been shrinking, the business has seen an earnings development of 24% in the identical interval. That is fairly worrisome.

The idea for attaching worth to an organization is, to an incredible extent, tied to its earnings development. What buyers want to find out subsequent is that if the anticipated earnings development, or the shortage of it, is already constructed into the share worth. Doing so will assist them set up if the inventory’s future seems promising or ominous. In case you’re questioning about ITV’s’s valuation, take a look at this gauge of its price-to-earnings ratio, as in comparison with its business.

Is ITV Making Environment friendly Use Of Its Earnings?

ITV has a excessive three-year median payout ratio of 57% (that’s, it’s retaining 43% of its income). This implies that the corporate is paying most of its income as dividends to its shareholders. This goes a way in explaining why its earnings have been shrinking. The enterprise is just left with a small pool of capital to reinvest – A vicious cycle that does not profit the corporate within the long-run. To know the three dangers we now have recognized for ITV go to our dangers dashboard without cost.

Moreover, ITV has paid dividends over a interval of not less than ten years, which signifies that the corporate’s administration is decided to pay dividends even when it means little to no earnings development. Upon learning the most recent analysts’ consensus information, we discovered that the corporate is anticipated to maintain paying out roughly 51% of its income over the following three years. Accordingly, forecasts counsel that ITV’s future ROE will probably be 20% which is once more, much like the present ROE.

Abstract

General, we really feel that ITV actually does have some optimistic elements to contemplate. But, the low earnings development is a bit regarding, particularly on condition that the corporate has a excessive charge of return. Buyers may have benefitted from the excessive ROE, had the corporate been reinvesting extra of its earnings. As mentioned earlier, the corporate is retaining a small portion of its income. Furthermore, after learning present analyst estimates, we found that the corporate’s earnings are anticipated to proceed to shrink sooner or later. To know extra concerning the firm’s future earnings development forecasts check out this free report on analyst forecasts for the corporate to seek out out extra.

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market each day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive development Tech and AI Firms

Or construct your individual from over 50 metrics.

Discover Now for Free

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by basic information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

-

News4 weeks ago

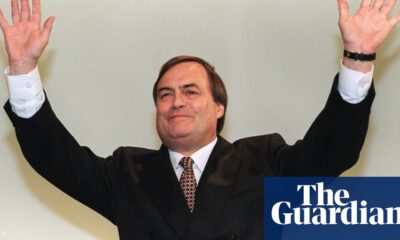

News4 weeks agoJohn Prescott, British former deputy prime minister, dies aged 86 | John Prescott

-

News3 weeks ago

News3 weeks agoHow to watch the 2024 Macy’s Thanksgiving Day Parade and who’s performing

-

News4 weeks ago

News4 weeks agoWayne Rooney net worth, key Plymouth decision and bumper Man United wages

-

News4 weeks ago

News4 weeks agoMaharashtra Assembly Election Results 2024 in charts

-

News4 weeks ago

News4 weeks agoWho were all the Sugababes members? From the original line up until now explained

-

News3 weeks ago

News3 weeks agoFormer snooker world champion Terry Griffiths dies after ‘lengthy battle with dementia’ | UK News

-

News4 weeks ago

News4 weeks agoWoman who accused Conor McGregor of rape wins civil assault case – and is awarded damages | World News

-

News4 weeks ago

News4 weeks agoSpaceX launches Starship rocket, but abandons attempt to catch booster at launch site