News

IRS obsoletes guidance governing section 501(c)(3) organizational requirements

Background

All part 501(c)(3) organizations should dedicate their property to a number of exempt functions described in part 501(c)(3). Treas. Reg. part 1.501(c)(3)-1(b)(4) typically gives {that a} part 501(c)((3) group will fulfill this requirement by together with a dissolution clause to this impact in its articles of group. Alternatively, a corporation fashioned in a state, the legal guidelines of which in any other case fulfill the dissolution requirement, needn’t embrace an categorical dissolution provision in its organizing doc. Rev. Proc. 82-2 recognized these states, allowing organizations fashioned in such jurisdictions to depend on state regulation with respect to their dissolution provisions.

Equally, a bit 501(c)(3) group categorised as a non-public basis underneath part 509(a) should embrace in its governing instrument provisions that require the group to adjust to the restrictions imposed by Chapter 42. Particularly, part 508(e) requires {that a} personal basis’s governing instrument require the muse to fulfill its minimal distribution requirement and prohibit the muse from participating in self-dealing, retaining extra enterprise holdings, making jeopardizing investments or making taxable expenditures. Treas. Reg. part 1.508-3(d) gives {that a} basis is deemed to fulfill this requirement if legitimate provisions of state regulation compel the muse act (or chorus from appearing) in the identical method. Rev. Rul. 75-38 offered a listing of states that enacted statutory provisions satisfying these necessities.

Rev. Proc. 2024-22 and Rev. Rul. 2024-10

IRS Chief Counsel attorneys have lately commented a few challenge to out of date each Rev. Proc. 82-2 and Rev. Rul. 75-38 as a result of state legal guidelines have materially modified within the final 40 years, creating confusion for IRS determinations brokers and taxpayers alike. Pursuant to Rev. Proc. 89-14, sections 7.01(5) and (6), income procedures and income rulings can’t be relied upon to the extent that they’re predicated on sate regulation that has materially modified. As a result of the lists of states in each items of steerage are not correct, the IRS launched Rev. Proc. 2024-22 and Rev. Rul. 2024-10 to formally out of date the sooner steerage.

PMTAs present up to date state regulation info

Additionally in public feedback, IRS Chief Counsel attorneys famous that often updating precedential steerage of this nature is each time-consuming and unrealistic. Nonetheless, non-precedential steerage, like PMTAs, are simpler to problem and supply a greater format for offering taxpayers with well timed steerage even when they can not formally depend on such steerage.

At the side of obsoleting the prior steerage, the IRS publicly launched PMTA 2024-02 and PMTA 2024-03, which offer state legal guidelines that fulfill the part 501(c)(3) organizational necessities associated to dissolution provisions and personal basis governing instrument necessities, respectively. The state regulation info is present by way of April 23, 2024.

RSM US takeaways

Compliance with organizational necessities is vital to acquiring and sustaining a corporation’s tax-exempt standing. The obsolescence of outdated steerage and the issuance of newly up to date PMTAs will allow the IRS to well timed present up to date administrative steerage with respect to essential modifications in state legal guidelines affecting exempt organizations. RSM recommends working intently with authorized counsel when drafting or amending organizational paperwork to make sure all state and federal tax regulation necessities are glad and, for the avoidance of doubt, additionally recommends together with the required language quite than counting on operation of state regulation. RSM can help in reviewing governing paperwork for compliance with federal tax regulation organizational necessities. As well as, we will put together and assessment exemption purposes to assist newly-formed organizations acquire exempt standing.

-

News4 weeks ago

News4 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News4 weeks ago

News4 weeks agoMerry Christmas from Carrboro – by Thomas Mills

-

News4 weeks ago

News4 weeks agoSanta Cruz Wharf collapse leads 3 city workers to be rescued in California

-

News4 weeks ago

News4 weeks agoOlympic snowboarder Sophie Hediger dies in avalanche accident | Snowboarding

-

News3 weeks ago

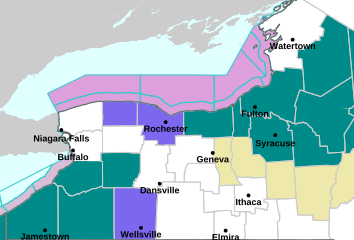

News3 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News3 weeks ago

News3 weeks agoOutstanding contributions by British nationals abroad recognised on the New Year 2025 Overseas and International Honours list

-

News4 weeks ago

News4 weeks agoPDC World Darts Championship 2025 results: Luke Humphries, Gerwyn Price & Peter Wright progress