News

Fulton Financial acquires Republic First Bank after first U.S. bank failure of 2024

By Invoice Peters

The transfer represents the newest crack – and the newest bandage job – within the beleaguered regional-banking business

After struggling beneath the load of upper rates of interest, Republic First Bancorp on Friday discovered one other regional lender prepared to rescue it: fellow Pennsylvania-based financial institution Fulton Monetary Corp.

Fulton mentioned late Friday that its subsidiary Fulton Financial institution had acquired “considerably the entire property” and snapped up “considerably the entire deposits” of Philadelphia-based Republic First, which ran 32 financial institution branches in Pennsylvania, New Jersey and New York beneath the identify Republic Financial institution.

Fulton purchased Republic First via an public sale run by the Federal Deposit Insurance coverage Corp. after Pennsylvania state banking regulators seized the troubled lender earlier Friday, the Wall Avenue Journal reported.

In a press release Friday night, the FDIC mentioned the state regulators had appointed it as Republic First’s receiver and that it subsequently “entered into an settlement” with Fulton Financial institution “to guard depositors.” The FDIC described Republic First as “the primary U.S. financial institution failure this yr.”

The announcement represents the newest crack – and the newest bandage job – within the beleaguered regional-banking business. Nonetheless, Republic First was comparatively tiny in comparison with different banks which have failed or teetered on failure for the reason that begin of final yr.

Increased rates of interest within the business have lower into the worth of some banks’ bonds – together with these at Republic First, the Journal reported Friday – whereas the ailing marketplace for business actual property, particularly within the workplace sector, has damage others, elevating considerations that depositors would possibly flee these monetary establishments.

Lancaster, Pa.-based Fulton, which holds round $27 billion in property, mentioned it had bought property value roughly $6 billion within the transaction – together with Republic First’s roughly $2 billion funding portfolio and round $2.9 billion in loans. The corporate mentioned it assumed liabilities of round $5.3 billion, together with deposits of some $4 billion and different borrowings and liabilities of roughly $1.3 billion.

Fulton mentioned Republic Financial institution depositors would nonetheless have entry to their accounts via on-line banking or by writing checks and utilizing ATMs and debit playing cards. These prospects would grow to be a part of Fulton’s depositors and wouldn’t need to make modifications to retain federally insured deposit-insurance protection, the corporate mentioned.

Fulton additionally mentioned that starting as early as Saturday, former Republic Financial institution places would reopen as Fulton Financial institution branches. The corporate added that it’s going to maintain a convention name on Monday morning to supply extra particulars on the transaction.

The transfer will improve Fulton’s presence alongside the East Coast. Fulton Financial institution operates at greater than 200 places throughout Pennsylvania, New Jersey, Maryland, Delaware and Virginia. In a press release, Fulton Chief Government Curt Myers mentioned the deal would “double our presence throughout the area.”

Shares of Fulton (FULT) have been up 10% after hours on Friday, whereas shares of Republic First (FRBK) closed at round a penny per share previous to the announcement.

The Wall Avenue Journal reported on the seizure and imminent sale of Republic First by regulators earlier on Friday. The financial institution managed to keep away from an public sale by the FDIC final yr after arranging a $35 million capital infusion from an investor. However that deal collapsed earlier this yr, and Bloomberg reported on Wednesday that the FDIC was in discussions with potential patrons for the financial institution.

The rescue of Republic First follows final yr’s collection of failures by a lot bigger regional banks, together with Silicon Valley Financial institution and Signature Financial institution. The struggling First Republic Financial institution was acquired by JPMorgan Chase & Co. (JPM) final yr.

This yr New York Neighborhood Bancorp. (NYCB) has encountered comparable issues, with the lender battling its publicity to the ailing business real-estate market and maneuvering to remain afloat following a steep inventory selloff.

-Invoice Peters

This content material was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is printed independently from Dow Jones Newswires and The Wall Avenue Journal.

(END) Dow Jones Newswires

04-27-24 0518ET

Copyright (c) 2024 Dow Jones & Firm, Inc.

-

News4 weeks ago

News4 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News4 weeks ago

News4 weeks agoMerry Christmas from Carrboro – by Thomas Mills

-

News4 weeks ago

News4 weeks agoSanta Cruz Wharf collapse leads 3 city workers to be rescued in California

-

News4 weeks ago

News4 weeks agoOlympic snowboarder Sophie Hediger dies in avalanche accident | Snowboarding

-

News3 weeks ago

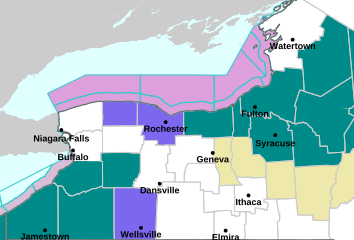

News3 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News3 weeks ago

News3 weeks agoOutstanding contributions by British nationals abroad recognised on the New Year 2025 Overseas and International Honours list

-

News4 weeks ago

News4 weeks agoChristopher Nolan’s next film announced as ‘mythic action epic’ The Odyssey | Movies