News

Caroline Ellison, whose testimony helped convict Sam Bankman-Fried, sentenced to two years in prison

A model of this story appeared in CNN Enterprise’ Nightcap e-newsletter. To get it in your inbox, join free, right here.

New York

CNN

—

A federal decide sentenced FTX co-founder Sam Bankman-Fried’s former girlfriend to 2 years in jail, citing her in depth cooperation with prosecutors that led to the conviction of the previous face of the cryptocurrency trade in one of many largest monetary frauds in US historical past.

Choose Lewis Kaplan cited Caroline Ellison’s “very, very substantial cooperation.”

Ellison informed the decide, “I feel on some stage my mind can’t even really comprehend the dimensions of the hurt it prompted. That doesn’t imply I don’t strive. I’m so so sorry.”

“I’m deeply ashamed of what we had carried out,” she added, sniffling and along with her voice cracking. Ellison’s dad and mom and two sisters sat behind her throughout the sentencing.

A fast recap:

- FTX was a buzzy, celebrity-backed startup that allowed individuals to purchase and promote digital belongings.

- It collapsed in November 2022, when clients pulled their funds en masse amid rumors about FTX’s unusually shut ties to its founder’s crypto hedge fund, Alameda Analysis.

- Ellison, who ran Alameda, pleaded responsible to seven federal counts of fraud and conspiracy shortly after FTX’s collapse. She was one among a number of firm insiders to show towards Sam Bankman-Fried, who based each corporations, and pinpoint him because the chief of a scheme to defraud buyers and steal $8 billion from FTX buyer funds.

- Bankman-Fried, who pleaded not responsible, was convicted and sentenced to 25 years in jail. He filed his enchantment final week.

Ellison’s testimony at Bankman-Fried’s trial final fall was essential.

In a memo to Choose Lewis Kaplan final week, prosecutors praised Ellison’s candor and “substantial help” within the investigation — a indisputable fact that performed a job in her sentencing regardless of going through the same checklist of prices as Bankman-Fried.

And on Tuesday, Kaplan famous Ellison incriminated herself whereas testifying and “pulled no punches.” He additionally drew comparisons with Bankman-Fried, who he sentenced to 25 years in jail, noting Ellison was culpable within the fraud, however mentioned what distinguished them is Ellison’s “outstanding cooperation.”

From the beginning, Ellison was the prosecution’s star witness — somebody who labored hand in glove with Bankman-Fried and who stored a contemporaneous diary chronicling the ups and downs of their enterprise and their often-rocky romantic relationship. And in a trial that centered on technical, advanced matters like digital belongings and decentralized finance, Ellison’s testimony supplied an emotional and relatable narrative.

Over three days on the stand, Ellison, who’s 29, repeatedly bolstered that all through her years at Alameda, the buck stopped with Bankman-Fried. When requested who directed her to hold out varied actions, prison or in any other case, she continuously replied “Sam did.”

In fact, some critics, together with Bankman-Fried’s protection legal professionals, have famous that Ellison may need been a compelling witness, however she was not a whistleblower.

“There is no such thing as a query she deserves leniency,” wrote Dennis Kelleher, president of the nonprofit group Higher Markets. However on the identical time, he mentioned, “she might have single-handedly stopped this fraud at any time, lengthy earlier than billions of {dollars} had been misplaced, a whole lot of buyers had been defrauded, and tens of hundreds of consumers had been ripped off.”

When FTX collapsed, clients had been locked out from their buying and selling accounts. However in a shock end result for a chapter, FTX property overseers mentioned that they had recovered sufficient belongings to pay most of its collectors again in full, with curiosity, due to a surge within the worth of its crypto holdings.

Authorized consultants had beforehand informed CNN it was unlikely Ellison would find yourself in jail.

Within the Southern District of New York, the place the case was tried, “the big majority of white-collar cooperators obtain zero jail time,” mentioned Jordan Estes, a former federal prosecutor who’s now a associate at Kramer Levin. And that’s significantly true after they have in any other case led a law-abiding life, she added.

Josh Naftalis, additionally a former federal prosecutor, famous that “a key subject that Kaplan will think about in sentencing Ellison is whether or not the scale of the fraud — billions of {dollars} in losses — nonetheless requires some time period of imprisonment.” Although Naftalis, now a white-collar protection legal professional at New York regulation agency Pallas, added that prosecutors’ description of her cooperation as “extraordinary,” prompt jail was unlikely.

Nonetheless, at Tuesday’s sentencing, the decide mentioned in a case this severe he couldn’t give her a get out of jail free card.

Different FTX executives’ circumstances are nonetheless in progress.

Ryan Salame, a former FTX government, was sentenced to greater than seven years in jail after pleading responsible to a marketing campaign finance violation and working an unlicensed cash transmission enterprise. Two different former executives, Nishad Singh and Gary Wang, who took plea offers and testified towards Bankman-Fried, are as a consequence of be sentenced this fall.

-

News4 weeks ago

News4 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News4 weeks ago

News4 weeks agoMerry Christmas from Carrboro – by Thomas Mills

-

News4 weeks ago

News4 weeks agoSanta Cruz Wharf collapse leads 3 city workers to be rescued in California

-

News4 weeks ago

News4 weeks agoOlympic snowboarder Sophie Hediger dies in avalanche accident | Snowboarding

-

News3 weeks ago

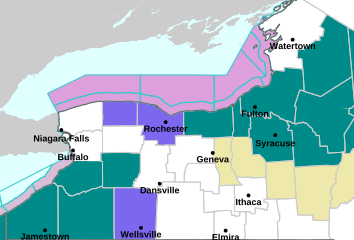

News3 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News3 weeks ago

News3 weeks agoOutstanding contributions by British nationals abroad recognised on the New Year 2025 Overseas and International Honours list

-

News4 weeks ago

News4 weeks agoPDC World Darts Championship 2025 results: Luke Humphries, Gerwyn Price & Peter Wright progress