News

BlackRock Shakes Up Private Credit to Chase Industry Leaders

(Bloomberg) — BlackRock Inc. is overhauling its non-public credit score enterprise because the world’s largest asset supervisor races to catch as much as opponents within the booming market.

Most Learn from Bloomberg

The agency is organising a brand new division, International Direct Lending, appointing Stephan Caron, head of the European middle-market non-public debt enterprise, to guide it. Jim Keenan, the worldwide head of BlackRock’s non-public debt enterprise and a two-decade firm veteran, will go away the agency subsequent 12 months, as will Raj Vig, co-head of US non-public capital.

Whereas BlackRock oversees $10.6 trillion, it sits outdoors the highest bucket within the booming private-credit markets and lags behind smaller corporations akin to Apollo International Administration Inc. and Ares Administration Corp. which have dominated.

“Personal credit score is likely one of the agency’s prime priorities,” Wealthy Kushel, head of BlackRock’s portfolio administration group, mentioned in a memo Monday. “This new construction will enhance collaboration and alignment as we increase and develop our capabilities whereas sustaining the discreet funding processes that underpin every franchise.”

The direct-lending unit is being arrange after growing calls for from traders, Kushel mentioned, and to “assist speed up our ambition to be a pacesetter in direct lending and progress debt globally.”

That is BlackRock’s newest step to reboot a enterprise that has develop into one in all Wall Road’s hottest investments. Apollo, Blackstone Inc. and KKR & Co. have expanded far past their roots in leveraged buyouts and personal fairness into direct lending and asset-based finance, whereas Ares., HPS Funding Companions and Sixth Road have gotten wealthy off non-public credit score lately.

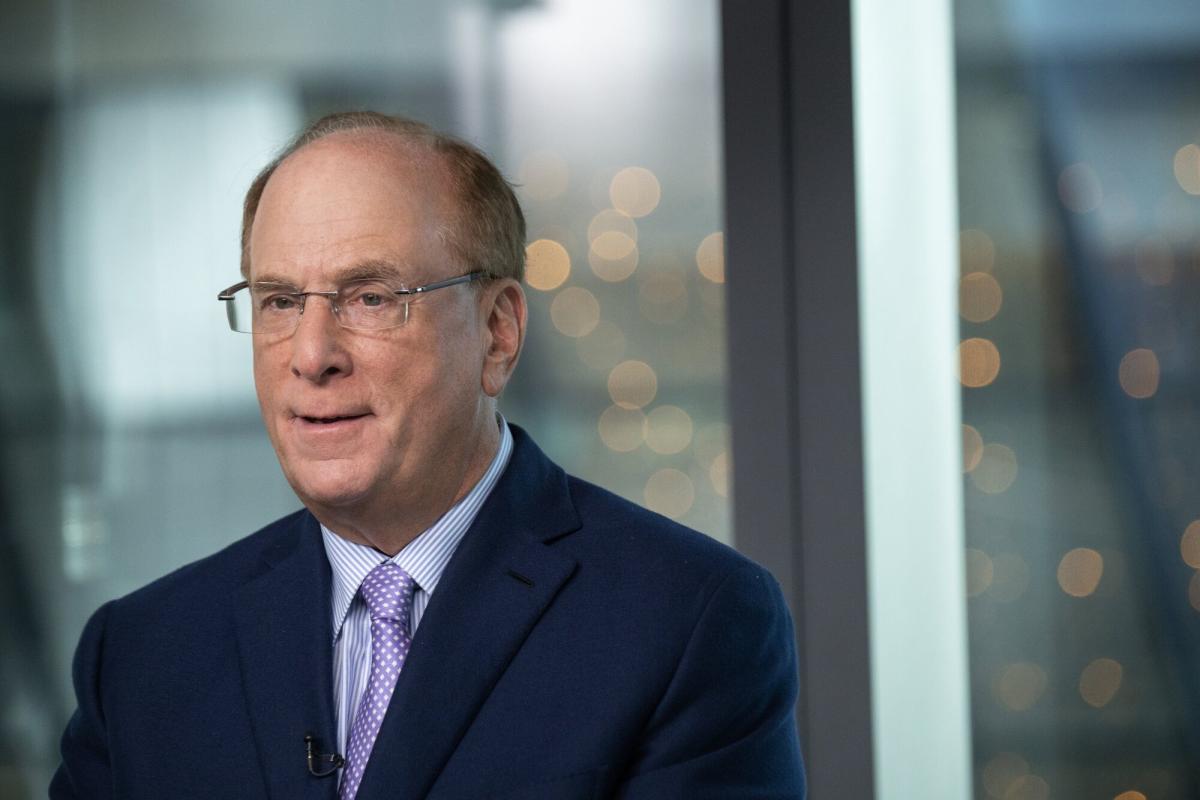

BlackRock Chief Govt Officer Larry Fink highlighted non-public credit score as a “main progress” driver, whereas the agency’s personal estimates present that direct lending will increase dramatically. The corporate’s head of macro credit score analysis, Amanda Lynam, predicted the worldwide non-public debt market would roughly double to $3.5 trillion by 2028, one of the vital bullish calls on the expansion of the trade.

BlackRock manages about $35 billion of direct lending property, which is about 0.3% of the $10.6 trillion the agency oversees. It manages $86 billion of personal debt. Apollo touts greater than $500 billion of property in credit score, and Ares had greater than $320 billion in credit property as of June 30.

For BlackRock, greatest recognized for capitalizing on a decade-long wave of flows into its inventory and bond index funds, the management shuffle is a part of its push into the profitable world of personal property. Whereas the $138 billion in illiquid property it managed was solely about 1.3% of the full agency’s property as of June 30, it represented about 6.4% of the agency’s general income from administration and efficiency charges within the second quarter.

The corporate goals to double its annual income from non-public property to about $2 billion by 2028.

As a part of that effort, BlackRock has gone on a shopping for spree, saying acquisitions this 12 months of International Infrastructure Companions for $12.5 billion and alternate options data-provider Preqin. The agency bought Kreos Capital, a non-public debt store in Europe, final 12 months and introduced a partnership this month with Companions Group Holding AG to arrange mannequin portfolios of personal property for rich retail shoppers.

Keenan was tapped in Might 2023 with overseeing non-public debt, which incorporates non-public credit score, direct lending and distressed investing methods, in addition to infrastructure and actual property debt. He was beforehand chief funding officer of credit score within the firm’s alternate options enterprise and led the agency’s public market credit score and leveraged finance enterprise.

Phil Tseng, who has co-led the US Personal Capital enterprise since 2021, will develop into the only real head, whereas Dan Worrell will develop into co-CIO of the unit, based on the memo.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.

-

News4 weeks ago

News4 weeks agoHow to watch the 2024 Macy’s Thanksgiving Day Parade and who’s performing

-

News4 weeks ago

News4 weeks agoWayne Rooney net worth, key Plymouth decision and bumper Man United wages

-

News4 weeks ago

News4 weeks agoMaharashtra Assembly Election Results 2024 in charts

-

News4 weeks ago

News4 weeks agoWho were all the Sugababes members? From the original line up until now explained

-

News3 weeks ago

News3 weeks agoFormer snooker world champion Terry Griffiths dies after ‘lengthy battle with dementia’ | UK News

-

News3 weeks ago

News3 weeks agoHuge 50ft sinkhole appears on Merthyr housing estate as homes evacuated

-

News4 weeks ago

News4 weeks agoWoman who accused Conor McGregor of rape wins civil assault case – and is awarded damages | World News

-

News3 weeks ago

News3 weeks agoThe Madness Netflix release date, cast, trailer, plot: Everything to know | TV & Radio | Showbiz & TV