News

Berkshire Hathaway: NYSE to cancel erroneous trades in Warren Buffett business after incident

On June 3, an information glitch led the worldwide conglomerate’s inventory worth to fall to $185 a share, having beforehand closed at over $620,000. The drop meant a greater than 99% low cost on the Warren Buffett–led firm.

This implies a dealer who snapped up simply $925 price of the inventory on the rock-bottom worth would now see that funding price over $3 million at this time.

Whereas it hasn’t been confirmed how many individuals bought the Class A inventory in the course of the technical error—which lasted for round an hour and a half—the New York Inventory Change (NYSE) has swiftly undone all their trades.

In an replace posted at 9 p.m. final night time, NYSE stated it will “bust” all of the “inaccurate” trades of Berkshire Hathaway inventory at or beneath $603,718.30 a share.

The problem, the change added, is said to an issue on the Consolidated Tape Affiliation (CTA), which offers real-time details about quotes and trades on the change. The CTA oversees a part of the Securities Data Processor (SIP) which consolidates all protected bid/ask quotes and trades right into a single information stream.

The CTA stated it skilled issues with worth banding which “could have been associated to a brand new software program launch” on SIP. Consequently, the CTA has reverted to the earlier model of the software program. The CTA didn’t instantly reply to Fortune’s request for remark.

Through the blip, the NYSE positioned halts on sure trades; it’s going to now search to find out that are inaccurate and thus eligible to be canceled. The technical challenge has now been resolved, it added, with all tickers buying and selling as regular.

Merchants who didn’t hop on a reduced Berkshire Hathaway inventory however did purchase closely discounted shares in different manufacturers will even be topic to having their trades struck off—with the ruling not eligible for attraction.

Different tickers that had been impacted embrace American restaurant chain Chipotle (CMG), mining firm Barrack Gold Company (GOLD), and meme inventory darling GameStop (GME).

For Berkshire Hathaway, the excellent news is that its Class B Inventory (BRK.B) was not impacted by the ticker drawback, and its Class A inventory closed at greater than $631,000 a share.

Berkshire Hathaway didn’t instantly reply to Fortune‘s request for remark.

Expensive errors

The Berkshire Hathaway mega-bargain is considered one of many hiccups skilled by varied worldwide inventory exchanges—and is unlikely to be the final.

Simply final week, stay information from the S&P 500 and the Dow Jones Industrial Common disappeared from merchants’ screens for round an hour, the Monetary Instances reported. The system then returned to regular; the reason for the outage is being investigated.

Whereas the NYSE challenge has been fastened with restricted fallout, the identical couldn’t be stated for a LSE incident that has value Wall Avenue large Citigroup tens of tens of millions.

In Could 2022, a London dealer bypassed tons of of warning notifications to create a basket price $444 billion.

Whereas $255 billion was blocked from buying and selling by Citi’s inside administration techniques, a basket price $189 billion was nonetheless launched to the worldwide markets.

A complete of $1.4 billion of equities had been bought throughout varied European exchanges earlier than the dealer canceled the order. Citi was fined practically $70 million by the U.Okay.’s Monetary Conduct Authority for the oversight and associated issues.

-

News4 weeks ago

News4 weeks agoHome Alone 2 star Tim Curry was born in Cheshire

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News4 weeks ago

News4 weeks agoMerry Christmas from Carrboro – by Thomas Mills

-

News4 weeks ago

News4 weeks agoSanta Cruz Wharf collapse leads 3 city workers to be rescued in California

-

News4 weeks ago

News4 weeks agoOlympic snowboarder Sophie Hediger dies in avalanche accident | Snowboarding

-

News3 weeks ago

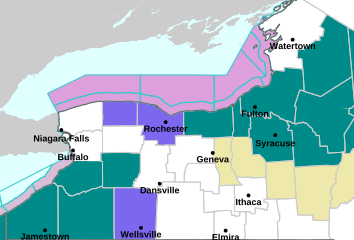

News3 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News3 weeks ago

News3 weeks agoOutstanding contributions by British nationals abroad recognised on the New Year 2025 Overseas and International Honours list

-

News4 weeks ago

News4 weeks agoBillionaire Vivek Ramaswamy is a Wall Street speculator accused of pump-and-dump schemes, not a scientist