News

Why Is DeepSeek Sinking Nvidia Stock?

HANGZHOU, CHINA – JANUARY 27, 2025 – A Illustration picture exhibits DeepSeek and Nvidia LOGO in Hangzhou … [+]

A number of weeks in the past, Chinese language AI analysis lab DeepSeek launched its open-source AI mannequin, DeepSeek-R1, which has drawn important consideration within the tech world. In line with a paper authored by the lab, the DeepSeek-R1 mannequin outperforms cutting-edge fashions similar to OpenAI’s o1 and Meta’s Llama AI fashions throughout a number of benchmarks. That is spectacular, on condition that the mannequin can also be open-source, cost-effective, and requires considerably much less computational energy in comparison with its rivals.

Now DeepSeek’s method seems to have set off alarm bells in Silicon Valley, the place most large tech giants have been relying extra on brute power — amassing a bigger inventory of GPU chips and servers and working lengthy mannequin coaching intervals. We imagine this improvement might doubtlessly have implications for Nvidia inventory, the dominant participant within the AI {hardware} house. Additionally, try our evaluation on: How Nvidia inventory might drop 50%.

DeepSeek’s Improvements

DeepSeek has reportedly restructured the inspiration of AI fashions, emphasizing software-driven useful resource optimization over {hardware} dependency. Though the corporate apparently makes use of tens of 1000’s of Nvidia’s H100 and H200 AI GPUs to coach its fashions, it has confronted constraints on account of U.S. export controls limiting entry to the newest chips. To beat this, DeepSeek has carried out revolutionary engineering tweaks, similar to customized communication schemes between chips to enhance information switch effectivity, memory-saving strategies, and reinforcement studying strategies to attenuate computational energy necessities. These optimizations end in drastically decrease prices in comparison with conventional massive language fashions. Individually, see: S&P To Crash Extra Than 40%? Half II

This value effectivity is mirrored within the API pricing for DeepSeek-R1, which prices simply $0.55 per million enter tokens and $2.19 per million output tokens — considerably undercutting OpenAI’s API charges of $15 and $60, respectively. Nevertheless, it stays unclear how rapidly DeepSeek can broaden its attain. The corporate’s business ambitions might face challenges because of the U.S. chip ban. Extra importantly, geopolitical tensions between the U.S. and China might create belief points for firms contemplating utilizing Chinese language-built massive language fashions. These components might restrict DeepSeek’s penetration in Western markets. Individually, if you need upside with a smoother trip than a person inventory, contemplate the Excessive High quality portfolio, which has outperformed the S&P, and clocked >91% returns since inception.

Influence On GPU Makers Like Nvidia

That being stated, we imagine that DeepSeek’s developments might immediate a second of reckoning for large tech firms. DeepSeek’s resource-efficient strategies might power a reconsideration of brute-force AI methods that depend on huge investments in computing energy. Nvidia has been the most important beneficiary of this method by the AI increase, with its GPUs considered the most effective performing for coaching and deploying AI fashions. Over the previous two years, firms have funneled huge assets into constructing AI fashions, driving Nvidia’s income up by over 125% in fiscal yr 2024 to $61 billion, with web margins nearing 50%.

If the business begins to take inspiration from the strategies DeepSeek makes use of in its open-source fashions, we might very properly see demand for AI Computing energy cool off. The underlying economics of the broader AI ecosystem have been weak within the first place, and most of Nvidia’s clients possible aren’t producing significant returns on their investments. This might speed up the shift towards cheaper, resource-optimized AI fashions.

Now the rise in NVDA inventory during the last four-year interval has been removed from constant, with annual returns being significantly extra unstable than the S&P 500. Returns for the inventory have been 125% in 2021, -50% in 2022, 239% in 2023, and 171% in 2024. The Trefis Excessive High quality Portfolio, with a set of 30 shares, is significantly much less unstable. And it has comfortably outperformed the S&P 500 during the last 4-year interval. Why is that? As a bunch, HQ Portfolio shares offered higher returns with much less threat versus the benchmark index; much less of a roller-coaster trip as evident in HQ Portfolio efficiency metrics. Given the present unsure macroeconomic setting round fee cuts and a number of wars, might NVDA face an identical scenario because it did in 2022 and underperform the S&P over the following 12 months — or will it see a robust soar?

We see a risk that the “fear-of-missing-out” pushed AI wave seen during the last two years might ease off on account of diminishing incremental efficiency positive aspects from bigger fashions and in addition as the supply of high-quality coaching information turns into a bottleneck. This shift towards extra environment friendly fashions might compound the affect of a possible slowdown for GPU makers similar to Nvidia.

Furthermore, Nvidia additionally faces mounting competitors from the likes of AMD in addition to its personal clients similar to Amazon, who’ve been specializing in growing and deploying their very own AI chips. Whereas Nvidia does have a complete software program ecosystem round its AI processors, together with programming languages that ought to assist it higher lock clients into its merchandise, the corporate might face stress. Nvidia’s premium valuation could not absolutely mirror these dangers. We worth Nvidia inventory at about $93 per share, roughly 35% beneath the present market worth. See our evaluation of Nvidia valuation: Costly or Low-cost.

NVDA Return In contrast With Trefis Bolstered Portfolio

Make investments with Trefis Market Beating Portfolios

See all Trefis Value Estimates

-

News4 weeks ago

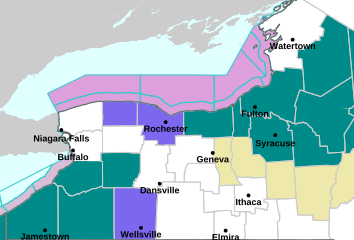

News4 weeks agoFlack Broadcasting – Lake Effect Snow WARNING in effect for the Entire Region

-

News4 weeks ago

News4 weeks agoThe Vivienne: RuPaul’s Drag Race UK and musical theatre star dies aged 32

-

News3 weeks ago

News3 weeks agoWhen is Super Bowl 2025? See date, time and NFL playoff picture

-

News3 weeks ago

News3 weeks agoMainoo ‘unhappy’ as Ratcliffe’s stance on three shock exits surfaces after U-turn

-

News3 weeks ago

News3 weeks agoApple Siri Eavesdropping Payout — Here’s Who’s Eligible And How To Claim

-

News3 weeks ago

News3 weeks agoNotre Dame defeats Penn State in Orange Bowl thriller, advances to title game

-

News4 weeks ago

News4 weeks agoReport: Leeds United 1-1 Blackburn Rovers

-

News3 weeks ago

News3 weeks agoCanadian PM Justin Trudeau may quit within days, say media reports