News

Balancing act: Enhancing target-date fund efficiency

Our TDF rebalancing coverage seeks to offer traders with one of the best probability for long-term funding success. To realize this objective, we goal to decrease transaction prices, that are a drag on returns, and restrict the danger from giant allocation drifts between rebalancing occasions.

Our analysis exhibits a threshold of 200 bps is appropriate throughout totally different forecast fashions, whereas a vacation spot of 175 bps results in decrease transaction prices compared with different locations. For a hypothetical 60% international fairness/40% international mounted revenue portfolio over a 10-year interval, Vanguard analysis exhibits that, when in comparison with calendar-based rebalancing methods, the 200/175 threshold-based rebalancing methodology leads to:

- Larger danger management. Allocation deviations are decrease and higher managed when using the 200/175 rebalancing methodology, which is predicted to lead to 43 bps much less allocation deviation per yr in contrast with month-to-month rebalancing and 135 bps much less in contrast with quarterly rebalancing.

- Diminished transaction prices. The anticipated transaction prices are about 13–17 bps decrease relative to quarterly and month-to-month approaches.

- Probably greater relative returns. The 200/175 rebalancing coverage leads to relative returns which are doubtlessly 11–18 bps greater per yr than calendar-based approaches.

The general profit to TDF traders might be substantial. As a part of the evaluation, the authors measured the relative good thing about rebalancing approaches utilizing the understanding charge equal, which might be interpreted because the charge an investor could be keen to pay for one rebalancing methodology over one other.

“We discovered that, for a TDF investor, the annual relative good thing about 200/175 rebalancing can vary from 5 to 21 bps when in comparison with calendar-based approaches,” stated Zhang. “That benefit can add as much as giant sums over time, enhancing an investor’s finest probability of funding success. Based mostly on our evaluation, the necessity for day by day monitoring is nicely well worth the potential for enhanced funding outcomes over the long run.”

-

News4 weeks ago

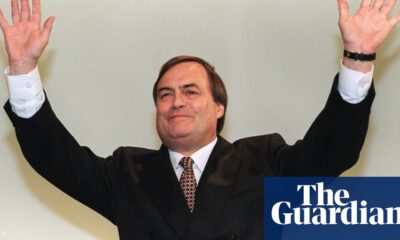

News4 weeks agoJohn Prescott, British former deputy prime minister, dies aged 86 | John Prescott

-

News3 weeks ago

News3 weeks agoHow to watch the 2024 Macy’s Thanksgiving Day Parade and who’s performing

-

News4 weeks ago

News4 weeks agoMaharashtra Assembly Election Results 2024 in charts

-

News4 weeks ago

News4 weeks agoWayne Rooney net worth, key Plymouth decision and bumper Man United wages

-

News4 weeks ago

News4 weeks agoWho were all the Sugababes members? From the original line up until now explained

-

News4 weeks ago

News4 weeks agoTrump names Pam Bondi for attorney general after Gaetz withdraws

-

News3 weeks ago

News3 weeks agoFormer snooker world champion Terry Griffiths dies after ‘lengthy battle with dementia’ | UK News

-

News4 weeks ago

News4 weeks agoWoman who accused Conor McGregor of rape wins civil assault case – and is awarded damages | World News